We're All Paying More Than Double What We Should for Healthcare

How America's Government Programs, Insurers & Hospitals Relentlessly Pilfer Private Plans

This week in the government-healthcare complex's gluttonous plundering of U.S. business, we saw that:

Cigna posted $1.3 billion in Q1 profit on the heels of learning that Cigna saves millions by having its doctors reject claims without reading them; and

UnitedHealthcare lost a 91 million dollar suit for chronic underpayment and unjust claim denials.

I read stories like this every week and become increasingly enraged at the cruel injustice of it.

We Already Have a Socialized System

The latest studies on the topic show that the American taxpayer funds 71% of all healthcare in blue states like California. That leaves 29% of healthcare costs funded by folks paying their own way to pay 224% of what the healthcare industry's largest customer (the federal government, primarily via Medicare and Medicaid) pays for the same procedures at the same facilities. Still think that the healthcare you receive at work is not taxed?

The rampant fraud riddling American healthcare boggles my mind. No, I'm not talking about the fact that one of every three dollars spent in the Medicare and Medicaid system is squandered on waste, fraud, or abuse1. Nor am I lamenting how America's largest purely socialized system, the Veteran's Administration, is so indifferent to our veteran's needs that it creates fake appointments at nonexistent clinics so it can show auditors that the wait times and abject patient neglect are not as they indeed are. I'm also not referring to how and why you overpay for prescriptions by at least 25% to 50%. Pharmacy benefits are a treasure trove of corrupt pricing, hidden rebates, and shell games that would expand this post beyond a reasonable length2.

Instead, I'm talking about the gargantuan tax every employer and employee3 pays for the "privilege" of buying commercial health insurance through the workplace. Because Medicare and Medicaid pay facilities4 so meagerly for services, hospitals respond by listing retail or chargemaster prices that are three, four, five, or even ten times as high for the same procedures at the same facilities.

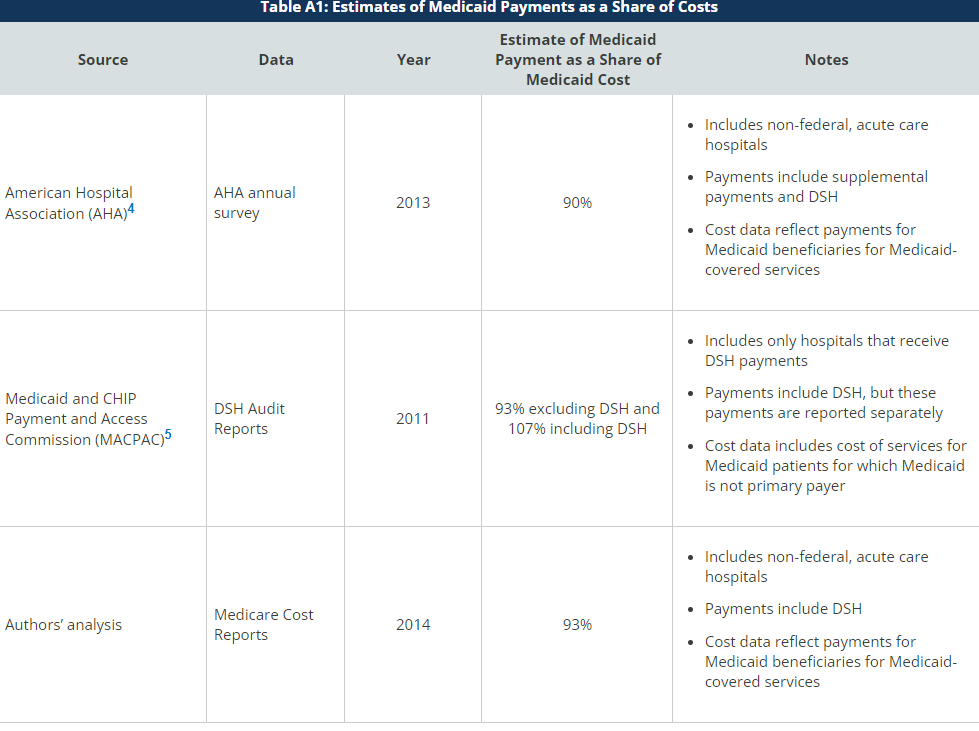

Below is a 2016 summary of cost data on Medicaid (for low-income) showing that, on average, Medicaid may not even cover the actual cost of providing services. Generally, Medicare (for the elderly) pays a little better than this in most states.

Your health insurer then negotiates a 50% discount on that completely phony "price" the facility claims through its chargemaster in the hopes that employers and employees will be mollified by the seemingly considerable discount they receive for the privilege of having a private plan. In the end, private payers pay a national average of 224% of Medicare and as high as 600% of a hospital's cost in a state like California.

Does your business get to mark up its products by 600%?

Additionally, those with self-funded plans know that you are also paying $20 per employee per month for that privilege of getting a 50% discount on a claim that's been fraudulently priced at 500% of Medicare. It is what Dave Chase, writing at Forbes, hypothesized might be "The Greatest Heist In American History."

Obamacare was going to fix this, right? Remember when President Obama stood in front of cameras and told us, tens of times, that the cost of healthcare was going to go down by $2,500 per family?

Here is what that government promise of a $2,500 reduction in family premiums looks like in real life. It is the orange line below. See the massive drop in 2010 and the continued drop over time? Neither do I.

But certainly, our fearless government leaders finally reined in the obscene carrier profits in order to protect the little guy with the passage of Obamacare, right? Not so much.

Since 2009 the S&P 500 is up 422%.

In that same time, five of the largest health insurer stock prices are up an average of 1,921%.

Okay, enough of this. I cannot stomach another fact in this vein.

Employers, There is Another Way

Three Steps to a 40% Cost Reduction - A HealthCost Revolution

Step 1: if you are too small to engage in any form of self-funding or partial self-funding, buy as little insurance as possible. The more premium you pay, the more you are pilfered. You have to get out of that game. Purchase the highest-priced deductible plan your insurer offers, then self-fund the amount under that deductible with a Health Savings Account (HSA) or Health Reimbursement Account (HRA). If you have less than about 250 employees, depending on your cash flow, industry, and geographic locations, this might be the best you can do.

Step 2: If you have more than about 250 employees, you should evaluate whether you can opt out of this fraud entirely, say goodbye to your insurers, and move to a reference-based pricing (RBP) system whereby you pay some reasonable margin over the Medicare price. For example, you might pay 120% to 140% of Medicare. It fundamentally works, is legally quite creative and astute, and will provide your employees with better benefits, lower costs, and more freedom.

Is the first step intimidating, potentially rocky, and one that requires plenty of education? Yes. But making this move will reduce the cost of your health plan by 20% to 40%.

I wrote about how this will be the only mechanism that has a meaningful chance of saving private healthcare in America back in 2020 here: America will dramatically change the way it provides health care by 2030

I recently wrote about the financial imperative of evaluating this process now, here: The fiduciary imperative of reference-based pricing: A legal and financial analysis.

And I was recently interviewed on the Armstrong and Getty Radio program, discussing this here.

Step 3: In conjunction with your move to a self-funded RBP platform, you then must also take control of your pharmacy coverage via a direct contract with a pharmacy benefit manager (PBM) or one of the newer consortiums that aggregate numerous employers under one set of contract terms to maximize the pharmacy discounts and rebates for you, not an insurer. This move alone reduces your pharmacy bill by 25% to 50%.

An Inconvenient Truth

Or should I say a "problematic" reality in the parlance of one of today's most overused buzzwords? Okay, I'm making myself nauseous again.

If your broker is not talking to you about what I call the HealthCost Revolution of:

Getting off of first-dollar insurance plans (i.e., moving to HRAs or HSAs);

Evaluating RBP; and

Getting your Rx out of the carrier world and into a direct PBM contract …

You need to fire them. Period. Hard stop.

I've been an attorney for 23 years and a full-time insurance broker for 21. The required education and licensing for brokers are hysterically ludicrous. In most states, it takes a one-week course and a junior-high education to become a licensed broker. Carrier influence dominates that process as agents-to-be are taught that they have an equal obligation to their carrier and policyholder. Future agents are trained that this is some sort of collaborative cuddle fest in which carriers, employers, and employees all sit around campfires, roast marshmallows, hold hands and sing Kumbaya.

Oof. I need to step away for a bit. Why do I insist on making myself so sick?

I recently created this meme for my team members after a carrier emailed us, explaining that the carrier did not expect me or my team to market my employer's policy this year, as asking for quotes every year is not the "best way to proceed."

Ha! Best for whom?

Yes, they are that brazen. They do not partner with you and are not your friends. Their job is to maximize revenue, and that means maximizing your premium.

Here is the reality. Every one of those three steps in the HealthCost Revolution reduces premiums and adds heaping piles of work to your broker's plate. The broker will be giving themselves a pay cut while requiring much more work and expertise. In fact, probably only about 5% to 10% of brokers in the West are qualified to install and manage a self-funded plan, as HMOs have been so dominant in the West that few brokers have had the opportunity to learn what they need to effectively manage this process.

I can hear some of you out there saying, "That's why we don't pay our broker a commission; she is on a fee basis."

To this, I respond, okay, great. At best, you've capped their pay and will be asking them to do much more work to install this protocol. Most likely, you are paying your broker a fee and allowing your carriers to also collect the commission that should be going to your broker. Yep, Obamacare created that double-dip trap as well. I wrote how and why that happened years ago here.

As a lawyer, my training is to protect my client (policyholder) in all cases. I scoff at the "equal duty to carrier and employer drivel" and act solely as my employer's advocate. Asking a broker to be the prosecutor, public defender, and judge in one proceeding is a bad joke.

Our healthcare system is a convoluted, byzantine myriad of corruption. I cannot stand by and refrain from screaming from the rooftop. Don't get me wrong. There are plenty of fantastic people in the healthcare system. In fact, I know that the vast majority of them are there for the right reasons. They want to help people.

But even good people cannot save a corrupt system.

That's right; it’s corrupt. I used to say it was broken, but it is not. It is designed this way. We didn't end up here by accident. If you doubt me, let me repeat:

Since 2009 the S&P 500 is up 422%.

In that same time, five of the largest health insurer stock prices are up an average of 1,921%.

The healthcare industry represents the largest employer and the largest lobbyist in the United States, spending $700 million lobbying legislators and regulators every year. It makes up 18.3% of the U.S. economy. At its highest levels, it is loaded with the shrewdest operators you can imagine. It uses artificial intelligence and massive data analytic tools to vacuum up every conceivable detail about every one of us, as I recently wrote about here: Weaponizing HIPAA privacy.

Furthermore, it is important to note that officials responsible for managing federal agencies tasked with supervising the United States healthcare system frequently transition from their governmental positions to leading roles in the very corporations they once regulated. The term for this phenomenon is "revolving door," which refers to the movement of government officials between public sector roles and private sector positions, often within industries they previously regulated. This repugnant twist enables them to capitalize on their expertise, influence peddling, and skillfully manipulate the governance system for the benefit of their new employers. Recently, The Survival Podcast highlighted this phenomenon through a thought-provoking illustration. Employing humor as a coping mechanism for such prevalent absurdity is essential; without the ability to find levity in these situations, I’d struggle to maintain my sanity.

In summary, it is crucial to understand that health insurers do not serve as your friends or allies. When Chief Financial Officers delegate the responsibility of managing health insurance expenses—which frequently rank as the second or third largest cost for employers—to Human Resources departments, they are neglecting their fiduciary duty to minimize costs in a reasonable manner. Human Resources professionals typically lack the legal expertise of attorneys and the financial acumen of finance executives, which further underscores the importance of involving the appropriate personnel in managing these critical expenses.

It is imperative that American businesses take decisive action to reduce healthcare costs by utilizing the innovative tools at their disposal and engaging the most competent consultants or brokers to aid them in this process. Failure to do so could result in the collapse of the employer-based healthcare system, leading to the implementation of a minimal, Medicaid-for-all arrangement. Under such a system, individuals with the means would acquire supplementary coverage, while those without would face extended wait times for necessary care and elective procedures. This will, in turn, prompt the departure of more top-tier providers from the system5.

It is essential to emphasize that this scenario envisions Medicaid for all, rather than Medicare. Despite the government's willingness to employ quantitative easing measures, injecting trillions of dollars into the economy at a moment's notice, Medicare remains prohibitively expensive—even for a nation with a $32 trillion debt and no hesitation to take on more.

Concluding on a lighthearted note, I would like to share two more memes. As the adage suggests, "A picture is worth a thousand words," so allow me to present an additional 2,000 words of insight.

Malcolm K. Sparrow, a professor at the Kennedy School of Government at Harvard University whose book License to Steal is a classic in the field, thinks that Medicare’s fraud-related losses may run “as high as 30 to 35 percent” of its budget. From Chapter 12 in Overcharged: Why Americans Pay Too Much For Health Care, by David A. Hyman and Charles Silver.

The following is an excerpt from the same book. It is an anecdotal example of just how corrupt our prescription rules and practices are:

Why do so many eye doctors use pricier Lucentis when cheaper Avastin is available? You guessed it: Medicare pays physicians a lot more for using Lucentis. A 2013 Washington Post article explained the finances.

Under Medicare repayment rules for drugs given by physicians, they are reimbursed for the average price of the drug plus 6 percent. That means a drug with a higher price may be easier to sell to doctors than a cheaper one. In addition, Genentech offers rebates to doctors who use large volumes of the more expensive drug.

Got that? Medicare pays doctors far more for administering Lucentis than Avastin to patients with wet macular degeneration because Genentech charges more for the former than the latter. Six percent of $2,300 is $138; 6 percent of $60 will barely buy you a white chocolate mocha at Starbucks. Genentech then sweetens the deal by giving doctors who use large amounts of Lucentis discounts that the doctors get to keep. It’s easy to see how Medicare put taxpayers and seniors on the hook for $1.2 billion in payments for Lucentis in 2012. The hard part is explaining why many doctors, to their credit, continue to use Avastin. The cost to taxpayers and elderly patients could be much higher.

I write "employer and employee" here to not confuse folks needlessly while making a different point. But make no mistake; employees pay for every nickel of this. We often fail to acknowledge this reality because, on its face, an employer generally deducts 10% to 50% of our healthcare premium and then pays the rest of the bill to the carrier monthly. However, every single penny comes from an employee's compensation. If the employer were not forced to fund those dollars into healthcare, that remuneration would be provided to employees in the form of pay, other benefits, time off, or efficiencies resulting in job/employment growth, etc. This is covered expertly in Chapter 1 of Marshall Allen's book, Never Pay the First Bill.

The same phenomenon exists for providers (doctors) as well as facilities, but the problem with providers is not nearly as pronounced as it is with facilities. Roughly 80% of a plan's claims occur with providers, but 80% of costs are generated via the high-cost services occurring in facilities (primarily hospitals).

America is projected to have a shortfall of 139,000 physicians by 2033, representing 13% of U.S. providers.

Craig,

I am a physician soon requiring to insure myself and my family. Which broker should I use?