When Congress passed Medicaid in 1965, they weren’t building a healthcare empire. They weren’t laying the foundation for a national maternity ward. And they certainly weren’t budgeting for a trillion-dollar entitlement plan that would rival defense spending.

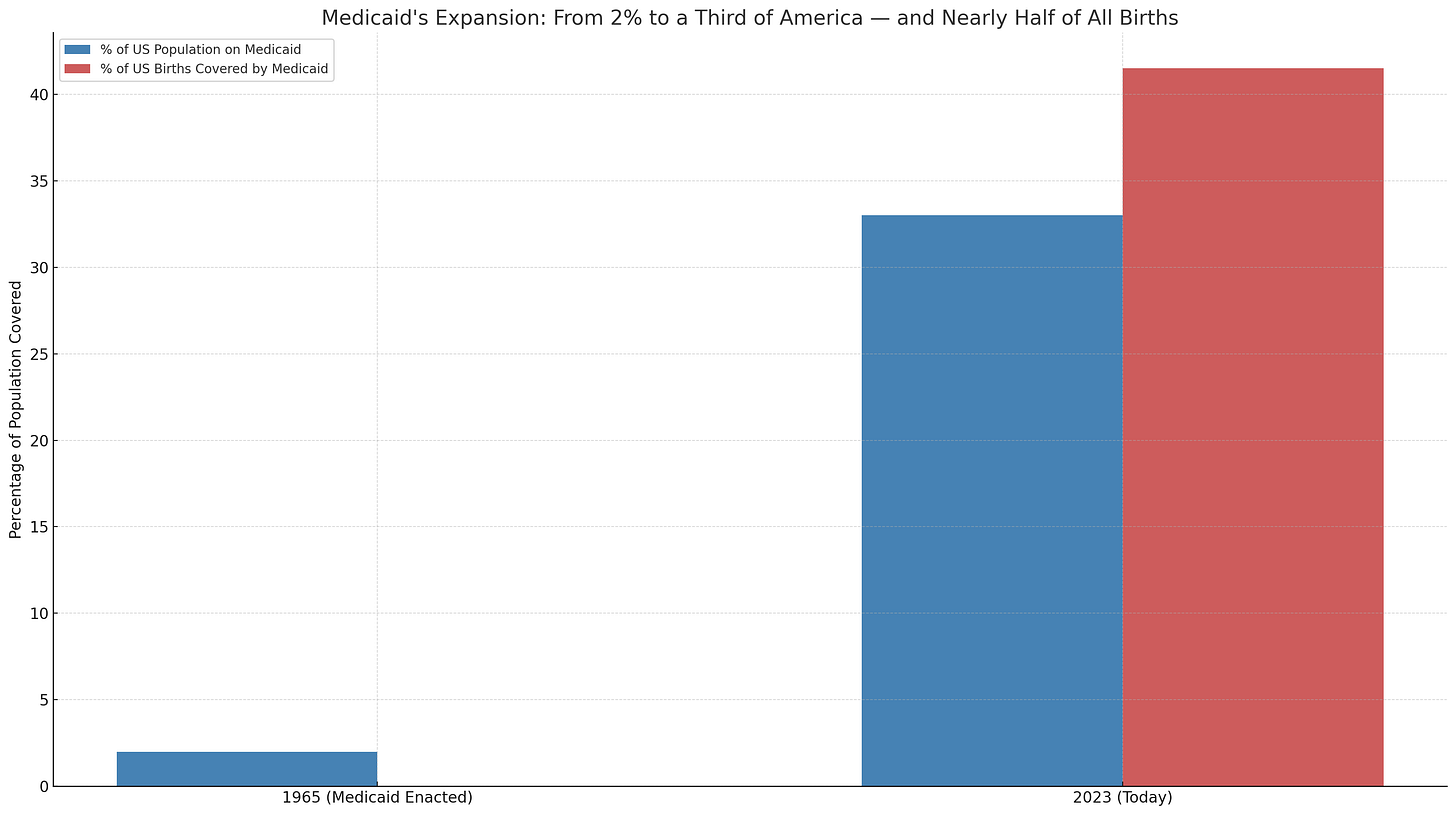

No, what they told the public was simple: this was a narrow, compassionate program for those truly down and out—the blind, the disabled, and moms with kids who were already receiving government aid. Maybe 2% of the population. Tops.

Fast forward six decades, and we now have one in three Americans riding the Medicaid train. In California, it’s almost 40% of the population. That’s not a safety net. That’s a hammock. A massive, bureaucratically stitched hammock with 90 million people swaying in it, while the rest of us wonder how we’re still expected to pay $2,000 for a run-of-the-mill MRI.

How did this happen?

It didn’t happen all at once, and it certainly didn’t happen with voters’ permission.

From Narrow Scope to Nationwide Default

The original Medicaid plan was stitched to welfare. If you weren’t receiving government cash, you didn’t get Medicaid. That was the deal. But like most things concocted in D.C., the program grew. Quietly. Bureaucratically. And with just enough complexity that by the time people noticed, it was already something else entirely.

First came the expansions in the '80s and '90s—pregnant women, kids, people with just a bit more income. Then came Obamacare, and suddenly we were subsidizing childless, able-bodied adults. That was the moment Medicaid went from a program to a lifestyle choice.

Then COVID hit. Congress suspended disenrollments. States stopped checking eligibility. And the Medicaid rolls burst open like an Illinois pension fund. Even after the public health emergency ended, tens of millions stayed enrolled—many of whom no longer qualified under the original terms.

Today, we have a Medicaid program designed for 2% of the country... covering over 90 million people.

This is mission creep with a gym membership and a human growth hormone prescription. Do you even lift, bro?

The day after this article was posted, I visited the Armstrong and Getty Radio show to discuss it with Jack and Joe, here:

Budgeting by Fairy Tale

Let’s talk about what this costs. Spoiler alert: it's not what we were told.

In 1967, two years into the program, the House Ways and Means Committee estimated Medicare would cost $12 billion by 1990. Medicare, not Medicaid. Still, it shows you how wildly optimistic—or willfully blind—those early projections were.

When 1990 finally arrived, Medicare’s actual cost was $98 billion. Off by a factor of eight.

And Medicaid? Even worse. “In 1987, Congress projected that Medicaid - the joint federal-state health care program for the poor - would make special relief payments to hospitals of less than $1 billion in 1992. Actual cost: $17 billion.” Merely a 17X aberration.

By 2000, it topped $200 billion. By 2023, we crossed the $800 billion mark. That’s approaching $1 trillion annually, just for Medicaid. Not Medicare. Not Social Security. Just Medicaid.

This program was sold to the public like a modest kitchen renovation. What we got was Trump Tower Dubai—gold-plated toilets, Italian marble, and a yearly tab we can’t even pretend to afford.

The National Nursery

Here’s another number no one in government wants to put on a billboard: Medicaid now finances 41.5% of all U.S. births. That’s right. Nearly half of American babies are born into a program that was never supposed to be more than a small, temporary lifeline.

In California, half of children are covered by Medicaid. In Mississippi and West Virginia? It’s more like 60%.

We’ve managed to turn a last-resort welfare program into the default payer for childbirth. And that comes with ripple effects. Hospitals rely on Medicaid dollars to deliver babies—at reimbursement rates that wouldn’t pay for the diapers, let alone the labor. So what do they do? They shift the cost to employer plans. To you. To me. To every company trying to keep health benefits afloat.

This isn’t a sustainable model. It’s a slow-motion collapse masked by benefit summaries and stop-loss insurance.

And Who’s Left Holding the Bag?

If you think employers haven’t noticed, think again. Every CFO who’s watched their renewal increase for no good reason knows exactly where this is going.

As Medicaid expands, employer-sponsored plans carry more of the financial burden. Medicaid underpays, so providers overcharge everyone else. The more people slide into “free” government coverage, the harder it gets for the private market to remain solvent. We’re eating our own tail here.

I regularly speak to CFOs of hospital systems who will sheepishly tell me that they can, in fact, make ends meet on Medicare reimbursements. Sure, they’d have to tighten their bets a bit and remove some of the bloat in the system. They might even have to stop paying the nonprofit hospital CEO $30 million a year, but they can do it. Medicaid, on the other hand? No. They openly scoff at the idea. For instance, one study found that base Medicaid payments for 18 selected conditions were, on average, 78% of Medicare rates

And what’s the public response?

Mostly shrugs. Medicaid’s expansion happened slowly enough and quietly enough that most people didn’t realize what was happening. And now that they’re on it? Good luck rolling it back.

Was This the Plan?

Some argue this was always the plan. That Medicaid expansion would be the Trojan Horse for a government-run health system. Others say it was just a series of bad assumptions, rubber-stamped expansions, and sloppy governance.

Frankly, I don’t care which it is. Either way, we’re stuck with a program that no longer resembles its original purpose—and no one in Washington seems all that interested in reining it in.

Until now.

A Sliver of Sanity

In May 2025, House Republicans finally tossed a wrench into the Medicaid machine.

Their proposal? Radical stuff like... work requirements for able-bodied adults. Eligibility verification. Restrictions on coverage for non-citizens. You know, things that any sane program would already be doing.

The Congressional Budget Office says these changes would save hundreds of billions over a decade and reduce enrollment by millions. Predictably, critics call it cruel.

But here’s what’s actually cruel: telling taxpayers they have to subsidize a bloated, unsustainable program while watching their own premiums skyrocket and their access to care shrink.

It’s not cruel to say the government should stop handing out health insurance like Halloween candy. It’s cruel to keep pretending this is fine.

Final Thought

We were promised a targeted, efficient way to help the vulnerable. What we got was a sprawling, bloated, trillion-dollar entitlement that now underwrites half the births in America and still can’t deliver timely care to those who need it most.

Medicaid wasn’t supposed to be forever. It wasn’t supposed to be for everyone. And it wasn’t supposed to cost this much.

And yet, here we are.

Now let’s see if anyone in Congress has the backbone to trim the sails before this ship hits the rocks.

This stuff makes me insane - and no one I talk to seems interested in learning about the problem or trying to fix anything. I think if more people (especially here in CA) had to pay their premiums out of pocket, there might be more backlash and support for change. For me, the $2,000/month premium for two adults is twice my mortgage and a little less than half of my yearly home owner's insurance. While our government is a circus-style shit show, I certainly hope that something can be done to at least stop some of the hemorraghing.

"burst open like an Illinois pension fund" - this should win the best metaphor of the year award!